UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATIONProxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

(Amendment No. )Filed by the Registrant

/X/þFiled by a Party other than the Registrant

/ / Check the appropriate box: /X/ Preliminary Proxy Statement / / Confidential,for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) / / Definitive Proxy Statement / / Definitive Additional Materials / / Soliciting Material Pursuant to ss.240.14a-11(c) or ss.240.14a-12 ALPHA 1 BIOMEDICALS, INC. - -------------------------------------------------------------------------------- (Name¨

| Check the appropriate box: | |

| þ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

RegeneRx Biopharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

- --------------------------------------------------------------------------------

(Name

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

/X/ No fee required.

/ /

| Payment of Filing Fee (Check the appropriate box): | |

| þ | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date Filed: |

Allan L. Goldstein, Ph.D.

Chairman and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed

pursuant to Exchange Act Rule 0-11 (set forth the amount on which the

filing fee is calculated and state how it was determined)

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

/ / Fee paid previously with preliminary materials.

/ / Check box if any part of the fee is offset as provided by Exchange Act

Rule 0-11(a)(2) and identify the filing for which the offsetting fee was

paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

[ALPHA 1 LETTERHEAD]

November 1, 2000

Chief Scientific Officer

August [—], 2019

Dear Fellow Stockholder:

You are cordially invited to attend the 2019 Annual Meeting (the “Meeting”) of Stockholders of Alpha 1 Biomedicals,RegeneRx Biopharmaceuticals, Inc. (the “Company”), to be held at 10:11:00 a.m., local time,Eastern Time, on Friday, December 15, 2000,September 27, 2019, at the Hyatt Regency Bethesda, locatedCompany office facility’s meeting room at 7400 Wisconsin

Avenue, Bethesda,15245 Shady Grove Road, Rockville, Maryland 20814.

20850.

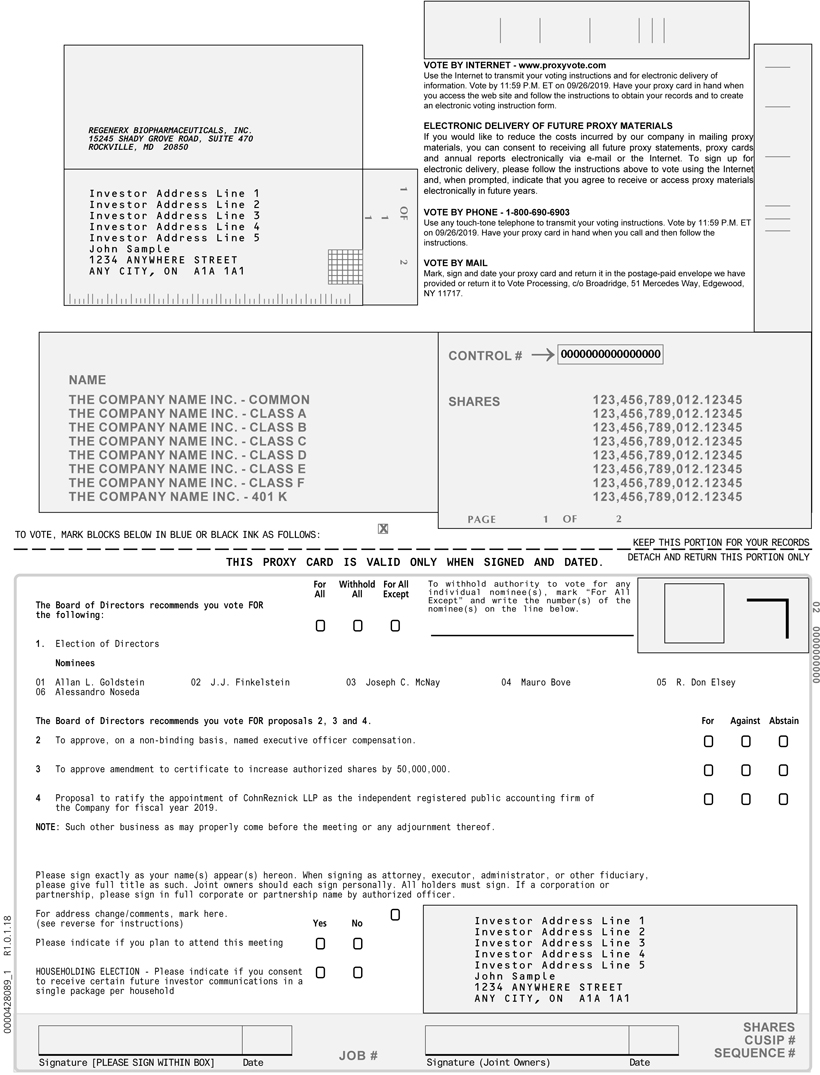

An important aspect of the annual meeting processMeeting is the stockholder vote on corporate business items. I urge you to exercise your rights as a stockholder to vote and participate in this process. Stockholders are being asked to consider and vote uponupon: (i) the election of threesix directors of the Company;Company, (ii) a proposednon-binding advisory resolution approving named executive officer compensation, (iii) the approval of an amendment to the Company's certificateCompany’s Certificate of incorporation to change the

Company's name from "Alpha 1 Biomedicals, Inc." to "RegeneRx Biopharmaceuticals,

Inc."; (iii) a proposed amendment to the Company's certificate of incorporationIncorporation to increase the number of shares of commonauthorized capital stock authorized for issuance from

20,000,000 to 100,000,000; (iv) approval of the Company's 2000 Stock OptionCompany by 50,000,000 shares, and Incentive Plan; and (v)(iv) the ratification of the appointment of Reznick Fedder &

Silverman, P.C.CohnReznick LLP, as the Company'sCompany’s independent auditors.

registered public accounting firm for the fiscal year ending December 31, 2019.

The Board of Directors has determined that approval of the matters to be considered at the Meeting is in the best interests of the Company and its stockholders.For the reasons set forth in the Proxy Statement, the Board unanimously recommends that you vote “FOR” each of the Board of Directors’ nominees as directors specified under Proposal 1, “FOR” the non-binding advisory resolution approving named executive officer compensation specified under Proposal 2, “FOR” the amendment to the Certificate to increase the authorized shares specified under Proposal 3, and “FOR” the ratification of the appointment of the independent registered public accounting firm specified under Proposal 4.

I encourage you to attend the meetingMeeting in person. Whether or not you plan to attend, however, please read the enclosed proxy statement and vote your shares and sign, date and return the proxy mailed to you, or vote over the telephone or the Internet as instructed in these materials as promptly as possible.possible. This will save the Company additional expense in soliciting proxies and will ensure that your shares are represented at the meeting.

Meeting.

Your Board of Directors and management are committed to the success of the Company and the enhancement of the value of your investment. As your Chairman

and President, I want to express my appreciation for your confidence and support.

Very truly yours,

Allan L. Goldstein

Chairman, President and Chief

Executive Officer

ALPHA 1 BIOMEDICALS,

| |

| Allan L. Goldstein, Ph.D. | |

| Chairman of the Board |

RegeneRx Biopharmaceuticals, Inc. | 15245 Shady Grove Road, Suite 470, Rockville, MD 20850

PHONE 301.208.9191 | FAX 301.208.9194 | WEB www.regenerx.com

REGENERX BIOPHARMACEUTICALS, INC.

3 Bethesda Metro Center,

15245 Shady Grove Road, Suite 700

Bethesda,470

Rockville, Maryland 20814

20850

(301) 961-1992

208-9191

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD DECEMBER 15, 2000

NOTICE IS HEREBY GIVEN that

To Be Held On Friday, September 27, 2019

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders (the “Annual Meeting”) of Alpha 1

Biomedicals,RegeneRx Biopharmaceuticals, Inc., a Delaware corporation (the “Company”). The Annual Meeting will be held as follows:

on Friday, September 27, 2019 at 11:00 a.m. local time in the meeting room of the Company’s office facility at 15245 Shady Grove Road, Rockville, Maryland 20850, for the following purposes:

| 1. | To elect | |

| 2. | To consider and vote upon a | |

| 3. | To | |

| 4. | To ratify the | |

| 5. | To |

These items of the Board

Bethesda, Maryland

November 1, 2000

ALPHA 1 BIOMEDICALS, INC.

3 Bethesda Metro Center, Suite 700

Bethesda, Maryland 20814

(301) 961-1992

--------------------------------------------

PROXY STATEMENT

--------------------------------------------

ANNUAL MEETING OF STOCKHOLDERS

DECEMBER 15, 2000

TABLE OF CONTENTS

PAGE

INTRODUCTION.................................................................................1

INFORMATION ABOUT THE ANNUAL MEETING.........................................................1

What is the purpose of the annual meeting?..........................................1

Who is entitled to vote?............................................................2

What if my shares are held in "street name" by a broker?............................2

How many shares must be present to hold the meeting?................................2

What if a quorum is not present at the meeting?.....................................2

How do I vote?......................................................................2

Can I change my vote after I submit my proxy?.......................................3

How does the Board of Directors recommend I vote on the proposals?..................3

What if I do not specify how my shares are to be voted?.............................3

Will any other business be conducted at the annual meeting?.........................3

How many votes are required to elect the director nominees?.........................3

What happens if a nominee is unable to stand for election?..........................4

How many votes are required to approve the other proposals?.........................4

How will abstentions be treated?....................................................4

How will broker non-votes be treated?...............................................4

STOCK OWNERSHIP..............................................................................4

Stock Ownership of Significant Stockholders, Directors and Executive Officers.......4

Section 16(a) Beneficial Ownership Reporting Compliance.............................6

PROPOSAL 1 - ELECTION OF DIRECTORS...........................................................6

Board of Directors' Meetings and Committees.........................................7

Directors' Compensation.............................................................7

Summary Compensation Table..........................................................8

Certain Transactions................................................................9

PROPOSAL 2 - AMENDMENT TO THE CERTIFICATE OF INCORPORATION

TO CHANGE THE COMPANY'S NAME........................................................10

PROPOSAL 3 - AMENDMENT TO THE CERTIFICATE OF INCORPORATION

TO INCREASE THE AUTHORIZED SHARES OF COMMON STOCK...................................10

PROPOSAL 4 - APPROVAL OF THE 2000 STOCK OPTION AND INCENTIVE PLAN............................12

i

PROPOSAL 5 - RATIFICATION OF APPOINTMENT OF AUDITORS........................................15

OTHER MATTERS...............................................................................16

ADDITIONAL INFORMATION......................................................................16

Proxy Solicitation Costs...........................................................16

Stockholder Proposals for 2001 Annual Meeting......................................16

ii

ALPHA 1 BIOMEDICALS, INC.

3 Bethesda Metro Center, Suite 700

Bethesda, Maryland 20814

(301) 564-4400

--------------------------------------------

PROXY STATEMENT

--------------------------------------------

INTRODUCTION

The Board of Directors of Alpha 1 Biomedicals, Inc. (the "Company") is

using this proxy statement to solicit proxies from the holders of the Company's

common stock for use at the Company's upcoming Annual Meeting of Stockholders.

The annual meeting will be held on December 15, 2000 at 10:00 a.m., local time,

at the Hyatt Regency Bethesda, located at 7400 Wisconsin Avenue, Bethesda,

Maryland 20814. At the annual meeting, stockholders will be asked to vote on

five proposals: (1) the election of three directors of the Company, each to

serve for a term expiring at next year's annual meeting of stockholders; (2) the

approval of a proposed amendment to the Company's certificate of incorporation

to change the Company's name from "Alpha 1 Biomedicals, Inc." to "RegeneRx

Biopharmaceuticals, Inc."; (3) the approval of a proposed amendment to the

Company's certificate of incorporation to increase the number of shares of

common stock authorized for issuance from 20,000,000 to 100,000,000; (4) the

approval of the Company's 2000 Stock Option and Incentive Plan; and (5) the

ratification of the appointment of Reznick Fedder & Silverman, P.C. as the

Company's independent auditors for the fiscal year ending December 31, 2000.

These proposals are more fully described in more detail below. Stockholders also will

consider any other matters that may properly come before the annual meeting,

although the Board of Directors knows of no other business to be presented.

By submitting your proxy, you authorize the Company's Board of Directors to

represent you and vote your shares at the annual meeting in accordance with your

instructions. The Board also may vote your shares to adjourn the annual meeting

from time to time and will be authorized to vote your shares at any adjournments

or postponements of the annual meeting.

The Company's Annual Report to Stockholders for the fiscal year ended

December 31, 1999, which includes the Company's annual financial statements, is

enclosed. Although the Annual Report is being mailed to stockholders withProxy Statement accompanying this proxy statement, it does not constitute a part of the proxy solicitation

materials and is not incorporated into this proxy statement by reference.

This proxy statement and the accompanying materials are being mailed to

stockholders on or about November 1, 2000.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL

MEETING, PLEASE VOTE PROMPTLY.

INFORMATION ABOUT THE ANNUAL MEETING

WHAT IS THE PURPOSE OF THE ANNUAL MEETING?

At the annual meeting, stockholders will be asked to vote on the following

proposals:

Proposal 1. Election of three directors of the Company, each for a term

expiring at next year's annual meeting of stockholders;

Proposal 2. Approval of a proposed amendment to the Company's

certificate of incorporation to change the Company's name

from "Alpha 1 Biomedicals, Inc." to "RegeneRx

Biopharmaceuticals, Inc.;"

Proposal 3. Approval of a proposed amendment to the Company's

certificate of incorporation to increase the number of

shares of common stock authorized for issuance from

20,000,000 to 100,000,000;

Proposal 4. Approval of the Company's 2000 Stock Option and Incentive

Plan; and

Proposal 5. Ratification of the appointment of Reznick Fedder &

Silverman, P.C. as the Company's independent auditors for

the fiscal year ending December 31, 2000.

Stockholders also will act on any other business that may properly come before

the annual meeting. Members of our management team will be present at the

meeting to respond to your questions.

WHO IS ENTITLED TO VOTE?

Notice.

The record date for the meetingAnnual Meeting is October 23, 2000.July 29, 2019. Only stockholders of record at the close of business on that date are entitled to notice of and tomay vote at the annual meeting. The only class of stock entitled to be voted at the

annual meeting is the Company's common stock. Each outstanding share of common

stock is entitled to one vote for all matters before the annual meeting. At the

close of business on the record date, there were 19,477,429 shares of common

stock outstanding.

WHAT IF MY SHARES ARE HELD IN "STREET NAME" BY A BROKER?

If your sharesor any adjournment thereof.

| By Order of the Board of Directors | |

| |

| Allan L. Goldstein, Ph.D. | |

| Chairman of the Board |

Rockville, Maryland

August [—], 2019

You are held in "street name" by a broker, your broker is

required to vote your shares in accordance with your instructions. If you do not

give instructions to your broker, your broker will nevertheless be entitled to

vote your shares with respect to "discretionary" items, but will not be

permitted to vote your shares with respect to "non-discretionary" items. In the

case of non-discretionary items, your shares will be treated as "broker

non-votes." Proposal 4 is expected to be considered a "non-discretionary" item.

All other proposals are expected to be considered "discretionary items."

HOW MANY SHARES MUST BE PRESENT TO HOLD THE ANNUAL MEETING?

A quorum must be present at the annual meeting for any business to be

conducted. The presence at the annual meeting, in person or by proxy, of the

holders of a majority of the shares of common stock outstanding on the record

date will constitute a quorum. Proxies received but marked as abstentions or

broker non-votes will be included in the calculation of the number of shares

considered to be present at the annual meeting.

WHAT IF A QUORUM IS NOT PRESENT AT THE ANNUAL MEETING?

If a quorum is not present at the scheduled time of the annual meeting, the

stockholders who are represented may adjourn the annual meeting until a quorum

is present. The time and place of the adjourned meeting will be announced at the

time the adjournment is taken. An adjournment will have no effect on the

business that may be conducted at the annual meeting.

HOW DO I VOTE?

1. YOU MAY VOTE BY PROXY. If you properly complete and sign the

accompanying proxy card and return it in the enclosed envelope, it will be voted

in accordance with your instructions. If your shares are held in "street name"

with a bank, broker or some other third party, you also may be able to submit

your proxy vote by telephone or via the internet. Check your proxy card to see

if voting by telephone and/or the internet is available to you.

2. YOU MAY VOTE IN PERSON AT THE ANNUAL MEETING. If you plancordially invited to attend the annualAnnual Meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and wishreturn the proxy that we may mail to you, or vote over the telephone or the Internet as instructed in these materials, as promptly as possible in order to ensure your representation at the meeting. Even if you have voted by proxy, you may still vote in person we will giveif you a ballot atattend the annual meeting. Note,Please note, however, that if your shares are held in "street name"

withof record by a broker, bank broker or some other third party,nominee and you will needwish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING TO BE HELD ON SEPTEMBER 27, 2019:

The Proxy Statement and Fiscal 2018 Annual Report to Stockholders are

available at:http://www.proxyvote.com

REGENERX BIOPHARMACEUTICALS, INC.

15245 Shady Grove Road, Suite 470

Rockville, Maryland 20850

(301) 208-9191

PROXY STATEMENT

FOR THE 2019 ANNUAL MEETING OF STOCKHOLDERS

September 27, 2019

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

The Board of Directors of RegeneRx Biopharmaceuticals, Inc. (the “Company”) is soliciting your proxy to vote at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held in the basement meeting room of the Company’s office facility at 15245 Shady Grove Road, Rockville, Maryland 20850 on Friday, September 27, 2019 at 11:00 a.m. local time, including at any adjournments or postponements of the Annual Meeting. You are invited to attend the Annual Meeting to vote on the proposals described in this proxy statement. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card, if you received paper copies of the proxy materials, or follow the instructions below to submit your proxy over the telephone or the Internet.

Why did I receive in the mail a Notice of Internet Availability of Proxy Materials instead of a full set of proxy materials?

We are pleased to take advantage of the SEC rule that allows companies to furnish their proxy materials over the Internet. Accordingly, we have sent to our beneficial owners a Notice of Internet Availability of Proxy Materials. Instructions on how to access the proxy materials over the Internet or to request a paper copy may be found in the Notice. Our stockholders may request to receive proxy materials in printed form by mail or electronically on an ongoing basis. A stockholder’s election to receive proxy materials by mail or electronically by email will remain in effect until the stockholder terminates its election.

Why did I receive a full set of proxy materials in the mail instead of a Notice of Internet Availability of Proxy Materials?

We are providing paper copies of the proxy materials instead of a Notice to our stockholders of record. If you are a beneficial owner or stockholder of record holderwho received a paper copy of the proxy materials, and you would like to reduce the environmental impact and the costs incurred by us in mailing proxy materials, you may elect to receive all future proxy materials electronically via email or the Internet.

You can choose to receive our future proxy materials electronically by visiting http://www.proxyvote.com. Your choice to receive proxy materials electronically will remain in effect until you instruct us otherwise by following the instructions contained in your Notice and visiting http://www.proxyvote.com, sending an electronic mail message to sendmaterial@proxyvote.com, or calling 1-800-579-1639.

The SEC has enacted rules that permit us to make available to stockholders electronic versions of the proxy materials even if the stockholder has not previously elected to receive the materials in this manner. We have chosen this option in connection with the Annual Meeting with respect to our beneficial owners and stockholders of record.

We intend to mail the Notice on or about August 30, 2019 to all stockholders of record entitled to vote at the Annual Meeting.

How do I attend the Annual Meeting?

The Annual Meeting will be held on Friday, September 27, 2019 at 11:00 a.m. local time at the Company office facility’s basement meeting room at 15245 Shady Grove Road, Rockville, Maryland 20850. Directions to the Company’s office facility may be found at: http://www.regenerx.com/wt/page/contact_us.Information on how to vote in person at the Annual Meeting is discussed below.

| 1 |

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on July 29, 2019 will be entitled to vote at the Annual Meeting. On this record date, there were 131,506494 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, on July 29, 2019, your shares indicating thatwere registered directly in your name with our transfer agent, American Stock Transfer & Trust, then you wereare a stockholder of record. As a stockholder of record, you may vote in person at the beneficial

owner of those shares on October 23, 2000, the record date for voting at

2

the annual meeting. You are encouraged tomeeting or vote by proxy prior to the annual

meeting even ifproxy. Whether or not you plan to attend the annual meeting.

CAN I CHANGE MY VOTE AFTER I SUBMIT MY PROXY?

Yes,meeting, we urge you to fill out and return a proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If on July 29, 2019, your shares were held, not in your name, but rather in an account at a brokerage firm, bank, dealer, or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may revokenot vote your proxy and change your vote at any time before the

polls close at the annual meeting by:

o submitting another proxy with a later date;

o giving written notice of the revocation of your proxy to the Company's

Secretary prior to the annual meeting; or

o votingshares in person at the annual meeting. Yourmeeting unless you request and obtain a valid proxy will not be

automatically revoked byfrom your mere attendance atbroker, bank or other agent.

There are four matters scheduled for a vote:

What if another matter is properly brought before the three nominees named in this proxy statement to

the Board of Directors; and

o FOR each of the other proposals.

WILL ANY OTHER BUSINESS BE CONDUCTED AT THE ANNUAL MEETING?

meeting?

The Board of Directors knows of no other businessmatters that will be presented for consideration at the annualAnnual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

You may either vote “For” all the nominees to the Board or you may “Withhold” your vote for any nominee you specify. For each of the other matters to be voted on, you may vote “For” or “Against” or abstain from voting. The procedures for voting are fairly simple:

| 2 |

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting, vote by proxy over the telephone, vote by proxy on the Internet or vote by proxy using a proxy card that you may request as set forth above or that we may deliver at a later time. Whether or not you plan to attend the meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the meeting and vote in person even if you have already voted by proxy.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank, or other agent, you should have received a Notice containing voting instructions from that organization rather than from us. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy from your broker, bank, or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions.

On each matter to be voted upon, you have one vote for each share of common stock you owned on July 29, 2019.

What if I return a proxy card or otherwise vote but do not make specific choices?

If you return a signed and dated proxy card or otherwise vote without marking voting selections, your shares will be voted, as applicable, “FOR” the election of all six nominees for director, “FOR” the advisory resolution on named executive officer compensation, “FOR” the approval of the amendment to the Certificate of Incorporation to increase the Company’s authorized shares by 50,000,000 shares, and “FOR” the ratification of the selection of CohnReznick as our independent registered public accounting firm for the fiscal year ending December 31, 2019. If any other matter is properly presented at the meeting, your proxyholder (the individual named on the proxy card) will vote your shares using his best judgment.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these proxy materials, our directors and employees may also solicit proxies in person, by telephone, or by other means of communication. Directors and employees will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

| 3 |

What does it mean if I receive more than one Notice?

If you receive more than one Notice, your shares may be registered in more than one name or in different accounts. Please follow the voting instructions oneach Notice to ensure that all of your shares are voted.

Can I change my vote after submitting my proxy or revoke my proxy?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If however,you are the record holder of your shares, you may revoke your proxy in any otherone of the following ways:

Your most current proxy card or telephone or Internet proxy is the one that is counted.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal properly comesmust be submitted in writing by April 1, 2020, to the Company’s Secretary at 15245 Shady Grove Road, Suite 470, Rockville, Maryland 20850. A stockholder proposal will need to comply with the SEC regulations under Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Although our Board of Directors will consider stockholder proposals, we reserve the right to omit from our proxy statement, or to vote against, stockholder proposals that we are not required to include under the Exchange Act, including Rule 14a-8. If you wish to bring a matter before the stockholders at next year’s annual meeting outside of our proxy materials and you do not notify us before April 1, 2020 for all proxies we receive, the proxyholders will have discretionary authority to vote on the matter, including discretionary authority to vote in opposition to the matter. If you wish to nominate a director for election at next year’s annual meeting, any such nomination shall be made by notice, in writing, to the Company’s Secretary not less than 14 days, nor more than 50 days, prior to the meeting. You are also advised to review our bylaws, which contain additional requirements about advance notice of director nominations.

Votes will be counted by the inspector of election appointed for the meeting.

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Proposals No. 1, 2 and 3 are considered to be “non-routine.” Proposal No. 4, the vote to ratify the selection for our independent registered public accounting firm, is considered to be “routine.”

| 4 |

How many votes are needed to approve each proposal?

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least a majority of the outstanding shares entitled to vote are present at the annual meeting in person or represented by proxy. On the record date, there were 131,506,494 shares outstanding and entitled to vote. Thus, the holders of 65,753,248 shares must be present in person or represented by proxy at the meeting to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the meeting. Abstentions and broker non- votes will be counted towards the quorum requirement. If there is no quorum, the holders of a majority of shares present at the meeting in person or represented by proxy may adjourn the meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a Current Report on Form 8-K, which we will file within four business days after the Annual Meeting.

ELECTION OF DIRECTORS

The Company’s Board of Directors currently consists of six directors. Each of the six continuing directors to be elected and qualified will hold office until the next Annual Meeting of Stockholders and until his successor is elected and qualified, or, if sooner, until the director’s death, resignation or removal. Each of the nominees listed below is currently a director of the Company who was previously elected by the stockholders. It is the Company’s policy to encourage nominees for directors to attend the Annual Meeting.

| 5 |

Directors are elected by a plurality of the votes of the holders of shares present in person or represented by proxy and entitled to vote on the election of directors. The six nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the five nominees named below. If any nominee becomes unavailable for election as a result of an unexpected occurrence, your shares may be voted for the election of a substitute nominee proposed by the Company. Each person nominated for election has agreed to serve if elected. The Company’s management has no reason to believe that any nominee will be unable to serve.

The following is a brief biography of each nominee for director and a discussion of the specific experience, qualifications, attributes or skills of each nominee that led the Board to recommend that person as a nominee for director, as of the date of this proxy statement. Ages are as of August 21, 2019.

We seek to assemble a board that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise and high-level management experience necessary to oversee and direct our business. To that end, our Board intends to maintain membership of directors who complement and strengthen the skills of other members and who also exhibit integrity, collegiality, sound business judgment and other qualities that we view as critical to effective functioning of the Board. The brief biographies below include information, as of the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each director or nominee that led the Board to believe that the director should serve on the Board.

| Name | Age | Principal Occupation/Position Held | Director since | |||

| Allan L. Goldstein | 81 | Former Chairman, Department of Biochemistry and Molecular Biology, The George Washington University School of Medicine and Health Sciences; Founder, Chairman of the Board and Chief Scientific Advisor of the Company | 1982 | |||

| J.J. Finkelstein | 67 | President and Chief Executive Officer of the Company | 2002 | |||

| Joseph C. McNay | 85 | Chairman, Chief Investment Officer and Managing Principal, Essex Investment Management Company | 1987 | |||

| Mauro Bove | 64 | Business Development consultant to emerging pharmaceutical companies in Asia, including Lee’s Pharmaceuticals | 2004 | |||

| R. Don Elsey | 66 | CFO of Lyra Therapeutics, a private therapeutic company | 2010 | |||

| Alessandro Noseda | 61 | CEO of Leadiant Biosciences S.p.A. | 2019 |

Dr. Goldsteinhas served as the Chairman of our Board of Directors and our Chief Scientific Officer since he founded our company in 1982. Dr. Goldstein is Emeritus Professor & former Chairman of the Department of Biochemistry and Molecular Medicine at the George Washington University School of Medicine and Health Sciences. Dr. Goldstein is a recognized expert in the field of immunology and protein chemistry, having authored over 435 scientific articles in professional journals. He is also the inventor on over 25 issued and/or pending patents in biochemistry, immunology, cardiology, cancer and wound healing. Dr. Goldstein discovered several important compounds, including Tß1, which is marketed worldwide, and Tß4, which is the basis for RegeneRx’s clinical program. Dr. Goldstein served on the Board of Trustees of the Sabin Vaccine Institute from 2000 to 2012 and on the Board of Directors of the Richard B. and Lynne V. Cheney Cardiovascular Institute from 2006 to 2012. Dr. Goldstein has also done pioneering work in the area of medical education, developing distance learning programs for the internet entitled “Frontiers in Medicine,” a medical education series that Dr. Goldstein developed. The Board believes that Dr. Goldstein’s scientific expertise, industry background and prior experience as holderour founder all position him to make an effective contribution to the medical and scientific understanding of your proxy, willthe Board, which the committee believes to be particularly important as we continue our Tß4 development efforts.

| 6 |

Mr. Finkelstein has served as our President and Chief Executive Officer and a member of our Board of Directors since 2002. Mr. Finkelstein also served as our Chief Executive Officer from 1984 to 1989 and as the Vice Chairman of our Board of Directors from 1989 to 1991. Mr. Finkelstein has worked as an executive officer and consultant in the bioscience industry for the past 36 years, including serving from 1989 to 1996 as chief executive officer of Cryomedical Sciences, Inc., a publicly-traded medical device company. Mr. Finkelstein has significant experience in developing early-stage companies. He has been responsible for the regulatory approval and marketing of several medical devices in the U.S. and abroad. Mr. Finkelstein has previously served on the executive committee of the Board of Directors of the Technology Council of Maryland and MdBio, Inc. and currently chairs the MdBio Foundation, all of which are non-profit entities that support bioscience development and education in the State of Maryland. Mr. Finkelstein received a business degree in finance from the University of Texas. The Board believes that Mr. Finkelstein’s history and long tenure as our Chief Executive Officer positions him to contribute to the Board his extensive knowledge of our company and to provide Board continuity. In addition, the Board believes that his experience at prior companies has provided him with operational and industry expertise, as well as leadership skills that are important to the Board.

Mr. McNayhas served as a member of our Board of Directors since 2002. He is currently Chairman, Chief Investment Officer and Managing Principal of Essex Investment Management Company, LLC, positions he has held since 1976 when he founded Essex. He has direct portfolio management responsibilities for a variety of funds and on behalf of private clients. He is also a member of the firm’s Management Board. Prior to founding Essex, Mr. McNay was Executive Vice President and Director of Endowment Management & Research Corp. from 1967. Prior to that, Mr. McNay was Vice President and Senior Portfolio Manager at the Massachusetts Company. Currently he is serving as Trustee of the Dana Farber Cancer Institute, member of the Children’s Hospital Investment Committee and is on the Board of Brigham & Women’s Hospital. He received his A.B. degree from Yale University and his M.B.A. degree in finance from the Wharton School of the University of Pennsylvania. The Board believes that Mr. McNay’s extensive financial experience is valuable to our business and also positions him to contribute to the audit committee’s understanding of financial matters.

Mr. Bovehas served as a member of our Board of Directors since 2004 and has more than 30 years of business and management experience within the pharmaceutical industry. Mr. Bove is currently based in Hong Kong and in Europe, serving as a consultant to emerging pharmaceutical companies worldwide. Previously, Mr. Bove led for more than 20 years the Corporate & Business Development of Sigma-Tau Finanziaria S.p.A., formerly the holding company of Sigma-Tau Group, a leading international pharmaceutical company (Sigma-Tau Finanziaria S.p.A. - now Essetifin S.p.a. - and its affiliates are collectively our largest stockholder). Mr. Bove, who resigned this role with Sigma-Tau on March 31, 2014, has also held a number of senior positions in business, licensing and corporate development within Sigma-Tau Group. Mr. Bove obtained his law degree at the University of Parma, Italy, in 1980. In 1985, he attended the Academy of American and International Laws at the International and Comparative Law Center, Dallas, Texas. The Board believes that Mr. Bove’s extensive business and management experience within the pharmaceutical industry allows him to recognize and advise the Board with respect to recent industry developments.

Mr. Elseyhas served as a member of our Board of Directors since September 2010. Currently Mr. Elsey serves as CFO of Lyra Therapeutics, a private company pioneering a new therapeutic approach to treat debilitating ear, nose and throat diseases. Previously Mr. Elsey served as CFO of Senseonics, Inc., from February 2015 to February 2019, a medical device company focused on continuous glucose monitoring. From May 2014 until February 2015 Mr. Elsey served as chief financial officer of Regado Biosciences, a public, late-stage clinical development biopharmaceutical company. From December 2012 to February 2014 Mr. Elsey served as chief financial officer of LifeCell, Inc., a privately held regenerative medicine company. From June 2005 to December 2012, he served in numerous finance capacities, most recently as senior vice president and chief financial officer, at Emergent BioSolutions Inc., a publicly held biopharmaceutical company. He served as the director of finance and administration at IGEN International, Inc., a publicly held biotechnology company, and its successor BioVeris Corporation, from April 2000 to June 2005. Prior to joining IGEN, Mr. Elsey served as director of finance at Applera, a genomics and sequencing company, and in several finance positions at International Business Machines, Inc. He received an M.B.A. in finance and a B.A. in economics from Michigan State University. Mr. Elsey is a certified management accountant. The Board believes that Mr. Elsey’s experience as chief financial officer of a public company is particularly valuable to our business in that it positions him to contribute to our board’s and audit committee’s understanding of financial matters.

| 7 |

Dr. Nosedais the Chief Scientific Officer (CSO) of Leadiant Biosciences S.p.A. and provides scientific and medical know-how to coordinate and manage the scientific and development programs at a global level as well as to evaluate new opportunities for the Leadiant Group. Since September 2018 he is also Chief Medical Officer of Leadiant Biosciences, Inc. After graduating as a Medical Doctor in 1984 at the University of Milan, and following a Post Doctorate at Bowman Gray School of medicine (USA), he joined the pharma industry in 1988 where he held different managerial positions within the R&D and Marketing organizations of multinational companies. He has acquired a significant experience in R&D (through the whole development process, from research to interaction with Health Authorities for MA submission or HTA assessment) and strategic/business operations. He joined sigma-tau in 1998 as Director of Scientific Office and Strategic Alliances within the Corporate R&D organization. In this position he managed key R&D projects and contributed to the finalization of important partnerships (e.g. with Novartis, Debiopharm etc.) and to the advancement of product development (from research to product registration). He has been part of the management Team and Board of Directors of biotech companies of the sigma-tau Group, as Thule Therapeutics, Metheresis Translational Research and Rostaquo. He has also been Chief Executive Officer of Leadiant Biosciences SA (formerly sigma-tau Research Switzerland) from 2007 to 2017, a position which he held in parallel with his former positions in sigma-tau (1988-2014) and later in Leadiant where he acted as Chief Medical Officer (2014-2017) before becoming the CSO. Under his management this company developed and advanced a proprietary technology and he guided the Company through the process to obtain the authorization by the Swiss Health Authorities to import and release medicinal products, as well as the Orpha Drug Designations and registration of new products (e.g. Chenodeoxycholic Acid or CDCA). He worked in several therapeutic (and diagnostic) areas, but mostly in high unmet medical need specialty areas as cancer, immune-oncology and rare diseases.

The Board recommends that you vote your shares“FOR” each of the nominees to the Board set forth in accordance with its best judgment.

HOW MANY VOTES ARE REQUIRED TO ELECT THE DIRECTOR NOMINEES?

Thethis Proposal 1. Under our Bylaws, the election of each nominee requires the affirmative vote of a plurality of the votes cast at the annual meeting

by the holders of shares present in person or by proxy at the annual meeting and

entitled to vote is required to elect the three nominees named in this proxy

statement as directors. This means that the three nominees will be elected if

they receive more affirmative votes than any other persons nominated for

election. No persons have been nominated for election other than the three

nominees named in this proxy statement. If you vote "Withheld" with respect to

the election of one or more nominees, your shares will not be voted with respect

to the person or persons indicated, although such shares will be counted for

purposes of determining whether there is a quorum.

WHAT HAPPENS IF A NOMINEE IS UNABLE TO STAND FOR ELECTION?

If a nominee is unable to stand for election, the Board of Directors may

either reduce the number of directors to be elected (if the Board first amends

the Company's Bylaws to permit the reduction) or select a substitute nominee.

3

If a substitute nominee is selected, the Board of Directors, as holder of your

proxy, will vote your shares for the substitute nominee unless you have withheld

authority to vote for the nominee replaced.

HOW MANY VOTES ARE REQUIRED TO APPROVE THE OTHER PROPOSALS?

The proposals to amend the Company's certificate of incorporation to change

the Company's name and to increase the number of shares of common stock

authorized for issuance must each be approved by the affirmative vote of a

majority of the outstanding shares of common stock. Approval of the 2000 Stock

Option and Incentive Plan and the ratification of the appointment of auditors

each require the affirmative vote of a majority of the votes cast by the holders

of shares present at the annual meeting in person or by proxy andstockholders entitled to vote on the matter. Approvalelection of directors at the 2000 Stock Option and Incentive Plan is

conditioned upon approval of the proposal to increase the number of authorized

shares. Therefore, if the proposal to increase the number of authorized shares

is not approved, then the proposal to approve the 2000 Stock Option and

Incentive Plan will be deemed not to have been approved. This is because the

remaining number of shares of common stock currently authorized for issuance is

not sufficient to allow for the grant of options under the 2000 Stock Option and

Incentive Plan.

HOW WILL ABSTENTIONS BE TREATED?

If you abstain from voting, your shares will still be included for purposes

of determining whetherAnnual Meeting at which a quorum is present. Because directors will be elected by

a plurality

INFORMATION REGARDING THE BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Independence of the votes castBoard of Directors

Although our common stock is no longer listed on the NYSE MKT exchange, we have determined the independence of our directors using the NYSE MKT definitions of independence. Under NYSE MKT listing standards, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by the holdersBoard. Our Board consults with counsel to ensure that its determinations are consistent with relevant securities and other laws and regulations regarding the definition of shares present“independent,” including those set forth in personpertinent listing standards of the NYSE MKT, as they may be modified from time to time.

Consistent with these considerations, after review of all relevant identified transactions or relationships between each director, or any of his family members, and our company, our senior management and our independent auditors, our Board has determined that the following three directors are independent directors within the meaning of the applicable NYSE MKT listing standards: Mr. Elsey, Mr. Bove, Dr. Noseda and Mr. McNay. In making this determination, the Board found that none of these directors had a material or other disqualifying relationship with us. Mr. Finkelstein, our President and Chief Executive Officer, and Dr. Goldstein our Chief Scientific Advisor, are not independent by proxy atvirtue of their employment with us.

In determining the annual meeting, abstaining isindependence of Mr. Bove, the board of directors took into account the significant ownership of our common stock by Sigma-Tau and its affiliates and our License Agreement with Lee’s Pharmaceuticals. The board of directors does not offered as a voting option for

Proposal 1. If you abstain from voting on any other proposal, your shares will

be included in the number of shares voting on the proposal and, consequently,

your abstention will have the effect of a vote against the proposal.

HOW WILL BROKER NON-VOTES BE TREATED?

Shares treated as broker non-votes on one or more proposals will be

included for purposes of calculating the presence of a quorum but will not be

counted as votes cast or treated as shares entitled to vote. Consequently,

broker non-votes will have the effect of votes against Proposals 2 and 3 (name

change and authorized shares increase) and no effect onbelieve that any of the transactions with Lee’s or Sigma-Tau and its affiliates described in this report has interfered or would reasonably be expected to interfere with Mr. Bove’s exercise of independent judgment in carrying out his responsibilities as a director of our company.

| 8 |

The Board has a chairman, Dr. Goldstein, who has authority, among other proposals.

STOCK OWNERSHIP

STOCK OWNERSHIP OF SIGNIFICANT STOCKHOLDERS, DIRECTORS AND EXECUTIVE OFFICERS

things, to call and preside over Board meetings, to set meeting agendas and to determine materials to be distributed to the Board. Accordingly, the Chairman has substantial ability to shape the work of the Board. We believe that separation of the positions of Chairman and Chief Executive Officer reinforces the independence of the Board in its oversight of our business and affairs. In addition, we believe that having a separate Chairman creates an environment that is more conducive to objective evaluation and oversight of management’s performance, increasing management accountability and improving the ability of the Board to monitor whether management’s actions are in our best interests and those of our stockholders.

Role of the Board in Risk Oversight

One of the Board’s key functions is informed oversight of our risk management process. The Board does not have a standing risk management committee, but rather administers this oversight function directly through the Board as a whole, as well as through various Board standing committees that address risks inherent in their respective areas of oversight. Our audit committee has the responsibility to consider and discuss our major financial risk exposures and the steps our management has taken to monitor and control these exposures, including guidelines and policies to govern the process by which risk assessment and management is undertaken. Our compensation committee assesses and monitors whether any of our compensation policies and programs has the potential to encourage excessive risk- taking.

Meetings of the Board of Directors

The Board met 10 times during our 2018 fiscal year.

Information Regarding Committees of the Board of Directors

During the fiscal year ended December 31, 2018, the Board maintained two standing committees: an Audit Committee and a Compensation Committee. The Board does not have a standing nominating and corporate governance committee. Rather, the independent members of the full Board perform the functions of a nominating and corporate governance committee.

The following table shows, as of October 23, 2000, the beneficial ownershipprovides membership and meeting information for fiscal 2018 for each of the Company's common stock by:

o any persons or entities known by management to beneficially own more

than five percentBoard’s standing committees:

| Name | Audit | Compensation | ||||||

| R. Don Elsey | X | X | * | |||||

| Joseph McNay | X | * | X | |||||

| Mauro Bove | X | |||||||

| Alessandro Noseda | X | |||||||

| Total meetings in fiscal 2018 | 4 | 1 | ||||||

| * | Committee Chairperson |

Below is a description of each committee of the outstanding shares of Company common stock;

o each directorBoard. Each of the Company;committees has authority to engage legal counsel or other experts or consultants as it deems appropriate to carry out its responsibilities. The Board has determined that each member of each committee meets the applicable NYSE MKT rules and o allregulations regarding “independence” and that each member is free of any relationship that would impair his individual exercise of independent judgment with regard to the Company

| 9 |

The Audit Committee consists of Mr. McNay and Mr. Elsey, with Mr. McNay acting as the Chairman of the executive officerscommittee. The Audit Committee meets no less than quarterly with management and directorsour independent registered public accounting firm, both jointly and separately, has sole authority to engage and terminate the engagement of our independent registered public accounting firm, and reviews our financial reporting process on behalf of the Company asBoard. The Audit Committee met four times during the 2018 fiscal year. The Audit Committee operates under a group.

4

The persons named informal written charter available on our website at www.regenerx.com.

Each member of the following table have sole voting and dispositive

powers for all shares of common stock shown as beneficially owned by them,

subject to community property laws where applicable and except as indicated in

the footnotes to the table.

Beneficial ownershipAudit Committee is an independent director determined in accordance with the rulesRule 10A-3 of the SecuritiesExchange Act. Furthermore, the Board has determined that Mr. McNay and Exchange Commission. SharesMr. Elsey qualify as “audit committee financial experts” as defined under SEC rules.

The Audit Committee pre-approves all audit and non-audit engagement fees, and terms and services. On an ongoing basis, management communicates specific projects and categories of common stock subjectservices for which advance approval of the Audit Committee is required. The Audit Committee reviews these requests and advises management and the independent auditors if the Audit Committee pre-approves the engagement of the independent auditors for such projects and services. On a periodic basis, the independent auditors report to outstanding options, warrantsthe Audit Committee the actual spending for such projects and services compared to the approved amounts.

Report of the Audit Committee of the Board of Directors

The following report of the Audit Committee shall not be deemed to be filed with the SEC or other rights to acquire heldincorporated by a person that

are currently exercisablereference in any previous or exercisable within 60 days after October 23, 2000

are included in the number of shares beneficially ownedfuture documents filed by the person and deemed

outstanding shares for purposesCompany with the SEC under the Securities Act of calculating the person's percentage

ownership. These shares are not, however, deemed outstanding for the purpose of

computing the percentage ownership of any other person. As of October 23, 2000,

there were 19,477,429 shares of Company common stock outstanding.

The Audit Committee reviews the Company’s financial reporting process on behalf of the Company's common stock, to report toBoard. Management has the SEC their initial ownershipprimary responsibility for the financial statements and the reporting process. The Company’s independent registered public accountant is responsible for performing an independent audit of the Company's common stockCompany’s financial statements and any subsequent changes in that ownership.

Specific due dates for these reports have been established byexpressing an opinion on the SEC and the

Company is required to disclose in this proxy statement any late filings or

failures to file.

To the Company's knowledge, based solely on its reviewconformity of the copiesaudited financial statements to generally accepted accounting principles.

The members of such reports furnished to the CompanyAudit Committee have reviewed and written representations that no other

reports were required duringdiscussed with management the Company’s audited financial statements as of and for the fiscal year ended December 31, 1999, all

Section 16(a) filing requirements applicable to the Company's executive officers

and directors during 1999 were met except for the inadvertent failure to report

on Form 5 one transaction by Dr. Goldstein.

PROPOSAL 1 - ELECTION OF DIRECTORS

The Company's Board of Directors consists of three directors. Directors are

elected annually to serve one-year terms.

The three individuals listed below each have been nominated for election as

a director at the annual meeting, to hold office until the next annual meeting

of stockholders and until his successor is elected and qualified. Each nominee

has consented to being named in this proxy statement and has agreed to serve if

elected. If a nominee is unable to stand for election, the Board of Directors

may either reduce the number of directors to be elected (if it first amends the

Company's Bylaws to permit the reduction) or select a substitute nominee. If a

substitute nominee is selected, the Board of Directors, as holder of your proxy,

will vote your shares for the substitute nominee, unless you have withheld

authority to vote for the nominee replaced.

The affirmative vote of a plurality of the votes cast at the annual meeting

by the holders of shares present in person or by proxy at the annual meeting is

required to elect the nominees named below as directors. YOUR BOARD OF DIRECTORS

RECOMMENDS THAT YOU VOTE "FOR" THE ELECTION OF EACH OF THE NOMINEES.

The following table sets forth, with respect to each nominee, his name and

age, the year in which he first became a director of the Company, and his

principal occupation and business experience during the past five years.

Based on the reviews and discussions referred to above, the Audit Committee recommended to the Board that the audited financial statements referred to above should be included in our Annual Report on Form 10-K accompanying this Proxy Statement and filed with the SEC for the fiscal 1999.

year ended December 31, 2018.

| Mr. Joseph McNay, Chairman | |

| Mr. R. Don Elsey |

| 10 |

The Compensation Committee consists of Mr. McNay, Mr. Elsey, and Mr. Bove with Mr. Elsey acting as the Chairman of the committee The Compensation Committee met once during the 2018 fiscal year. The Compensation Committee has adopted a written charter that is responsibleavailable to stockholders on our website at www.regenerx.com.

The Compensation Committee of the Board acts on behalf of the Board to review, adopt and oversee our compensation strategy, policies, plans and programs, including:

Compensation Committee Processes and Procedures

Typically, the Compensation Committee meets at least two times annually and with greater frequency if necessary. The agenda for each meeting is usually developed by the Chairman of the Compensation Committee, in consultation with certain executive officers, including the Chief Financial Officer. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation or individual performance objectives. The charter of the Compensation Committee grants the Compensation Committee authority to obtain, at the expense of the Company, advice and assistance from internal and external legal, accounting or other advisors and consultants and other external resources that the Compensation Committee considers necessary or appropriate in the performance of its duties. In particular, the Compensation Committee has the authority to retain compensation consultants to assist in its evaluation of executive and director compensation, including the authority to approve the consultant’s reasonable fees and other retention terms.

Historically, the Compensation Committee has made most of the significant adjustments to annual compensation, determined bonus and equity awards and established new performance objectives at one or more meetings held during the first half of the year. Generally, the Compensation Committee’s process comprises two related elements: the determination of compensation paidlevels and the establishment of performance objectives for the current year. For executives other than the Chief Executive Officer, the Compensation Committee solicits and considers evaluations and recommendations submitted to the Compensation Committee by the Chief Executive Officer. In the case of the Chief Executive Officer, the evaluation of his performance is conducted by the Compensation Committee, which determines any adjustments to his compensation as well as awards to be granted. For all executives and directors, as part of its deliberations, the Compensation Committee may review and consider, as appropriate, materials such as financial reports and projections, operational data, tax and accounting information, tally sheets that set forth the total compensation that may become payable to executives in various hypothetical scenarios, executive officers. and director stock ownership information, company stock performance data and analyses of historical executive compensation levels and current Company-wide compensation levels.

| 11 |

Nominating and Corporate Governance

The Board does not have a standing nominating and corporate governance committee. Instead, the independent members of the Compensation

CommitteeBoard, currently consisting of Messrs. Elsey, McNay, Noseda, and Bove, are Directors McNay and Rosenfeld. The Compensation Committee did not

meet in fiscal 1999.

The Stock Option Committee is responsible for administering the Company's

stock option plansperforming key nominating and in this capacity approves stock option grants. Each

director is a membercorporate governance activities on behalf of the Stock Option Committee. The Stock Option Committee

did not meet in fiscal 1999.

The entire Board, of Directorsincluding identifying, reviewing and evaluating candidates to serve as directors of the Company, acts as the Nominating

Committee forreviewing and evaluating incumbent directors, selecting nomineescandidates for election to the Board.Board, making recommendations to the Board regarding the membership of the committees of the Board, assessing the performance of management and developing and maintaining a set of corporate governance principles for the Company.

In identifying and evaluating nominees for director, the Board considers whether the candidate has the highest ethical standards and integrity and sufficient education, experience and skills necessary to understand and wisely act upon the complex issues that arise in managing a publicly held company. The Nominating

Committee generally meets once perBoard also believes that it is essential that the Board members represent diverse viewpoints. To the extent the Board does not have sufficient information to evaluate a candidate the Board may send a questionnaire to the candidate for completion with sufficient time for Board consideration. The Board will annually assess the qualifications, expertise, performance and willingness to serve of existing directors. If at this time or at any other time during the year the Board determines a need to make nominations. add a new director with specific qualifications or to fill a vacancy on the Board, a director designated by the Board will then initiate the search, seeking input from other directors and senior management, and will also consider any nominees previously submitted by stockholders. After identifying an initial slate of candidates satisfying the qualifications set forth above, the Board will then prioritize the candidates and determine if other directors or senior management have relationships with the preferred candidates and can initiate contacts. To the extent feasible, all of the members of the Board will interview the prospective candidates. Evaluations and recommendations of the interviewers will be submitted to the whole Board for final evaluation. The Board will meet to consider such information and to select candidates for appointment to the Board at the Annual Meeting. The independent members of the Board nominated the six directors set forth in Proposal 1 for election at the 2019 Annual Meeting.

Nominations for Election to the Board

While the Nominating CommitteeBoard will consider nominees recommended by stockholders, the Nominating CommitteeBoard has not actively solicited such nominations. The Board does not intend to alter the manner in which it evaluates candidates based on whether or not the candidate was recommended by a stockholder. Pursuant to the Company'sCompany’s bylaws, nominations for election as directors by stockholders at an annuala meeting of stockholders called for the election of directors must be made in writing and delivered to the Company'sCompany’s Secretary not less than 14fourteen days nor more than 120fifty days prior to the date of the meeting. If, however, notice of the meeting is given to stockholders less than 21twenty-one days prior to the meeting, the nominations must be received by the close of business on the seventh day following the day on which notice of the meeting was mailed to stockholders. DIRECTORS' COMPENSATION

Prior to the Company's suspension of operations in 1998, non-employee

directors (Directors McNay and Rosenfeld) were each paid an annual fee of $5,000

and a fee of $1,250 for each meeting attended in person, and were reimbursed for

expenses incurred in attending Board meetings. Upon the suspension of

operations, the Company discontinued paying director fees. It is uncertain when

the Company will reinstitute the payment of director fees. Each of Directors

McNay and Rosenfeld are owed director fees earned prior to the suspension of

operations amounting to $13,916. It is uncertain when these amounts will be paid

and whether these amounts will be paidsuch notice shall set forth, with interest.

7

SUMMARY COMPENSATION TABLE

The following table summarizes for the years indicated the compensation

paid by the Companyrespect to each person who served asnominee, (i) his or her name, age, business address and, if known, residence address, (ii) his or her principal occupation or employment, and (iii) the Company's Chief Executive

Officer during 1999. No other executive officernumber of shares of stock of the Company earned a salary

and bonus for 1999 in excess of $100,000.

Long Term

Annual Compensation Compensation Awards

--------------------------------------------- -----------------------

Other Restricted

Annual Stock All Other

Fiscal Compensation Award Options Compen-

Name and Principal Position Year Salary Bonus ($)(2) ($) (#) sation

--------------------------- ---- ---------- ----- ------------ ---------- --------- ---------

Allan L. Goldstein, President and 1999 --- --- --- --- 1,875,000 ---

Chief Executive Officer(1) 1998 --- --- --- --- --- ---

1997 --- --- --- --- 455,121 ---

Michael L. Berman 1999 $ 22,816 --- --- --- --- ---

Former Chief Executive Officer 1998 104,617 --- --- --- --- ---

1997 149,820 --- --- --- 682,682 $2,960

- -----------------

(1) Dr. Goldstein was appointed Chief Executive Officer upon the resignation of

Dr. Berman in July 1999.

(2) Neither Dr. Goldstein nor Dr. Berman received personal benefits or

perquisites which exceeded the lesser of $50,000 or 10% of his salary and

bonus.

The following table sets forth certain information concerning grants of

stock options to Drs. Goldstein and Berman during fiscal 1999.

===============================================================================================

OPTION GRANTS IN LAST FISCAL YEAR

Individual Grants

-------------------------------------------------------------------

Number of % of Total

Shares Options

Underlying Granted to Per Share

Options Employees in Exercise Expiration

Granted Fiscal Year Price Date

- -----------------------------------------------------------------------------------------------

Allan L. Goldstein 1,875,000 100% $0.04 08/15/09

Michael L. Berman --- --- --- ---

===============================================================================================

8

The following table provides information as tobeneficially owned by the valuenominee. As of the stock

options held by Drs. Goldstein and Berman asdate of December 31, 1999 and the values

realized by them upon the exercise of stock options during fiscal 1999.

===================================================================================================================

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR AND FY-END

OPTION VALUES

- -------------------------------------------------------------------------------------------------------------------

Number of

Securities Value of

Underlying Unexercised

Unexercised In-the-Money

Options at Options at

FY-End (#) FY-End ($)

---------------------------- ------------------------------

Shares

Name Acquired Value

on Exercise Realized Exercisable Unexercisable Exercisable Unexercisable

(#) ($) (#) (#) ($) ($)

- -------------------------------------------------------------------------------------------------------------------

Allan L. Goldstein --- $--- 1,875,000 --- $---(1) $---

Michael L. Berman --- --- --- --- --- ---

===================================================================================================================

(1) An option is in-the-money if the exercise price of the option is less than

the market value of the stock underlying the option. None of Dr. Goldstein's

options were in-the-money as of December 31, 1999.

CERTAIN TRANSACTIONS

LOAN TO DR. GOLDSTEIN. In May 1994,this proxy statement, the Company extended a loanhas not received any such nominations from stockholders in connection with the amount of $149,000 to Dr. Goldstein for the purpose of enabling Dr. Goldstein to

meet a margin call on a brokerage account collateralized by Company common stock

at a time whenAnnual Meeting.

Stockholder Communications with the Board of Directors concluded

The Company has established procedures for its security holders to communicate directly with the Board on a confidential basis. Security holders who wish to communicate with the Board or with a particular director may send a letter to the Secretary of the Company at 15245 Shady Grove Road, Suite 470, Rockville, Maryland 20850. The mailing envelope must contain a clear notation indicating that itthe enclosed letter is a “Security Holder-Board Communication” or “Security Holder-Director Communication.” All such letters must identify the author as a security holder and clearly state whether the intended recipients are all members of the Board or specified individual directors. The Secretary will make copies of all such letters and circulate them to the directors addressed. If a security holder wishes the communication to be confidential, such security holder must clearly indicate on the envelope that the communication is “confidential.” The Secretary will then forward such communication, unopened, to the individual indicated.

| 12 |

We have adopted a corporate code of conduct and ethics that applies to all of our employees, officers and directors, as well as a separate code of ethics that applies specifically to our principal executive officer and principal financial officer. The corporate code of conduct and ethics and the code of ethics for our principal executive and financial officers are available on our corporate website at www.regenerx.com. If we make any substantive amendments to the corporate code of conduct and ethics or the code of ethics for our principal executive and financial officers, or grant any waivers from a provision of these codes to any executive officer or director, we will promptly disclose the nature of the amendment or waiver on our website.

APPROVAL, ON AN ADVISORY BASIS, OF NAMED EXECUTIVE OFFICER COMPENSATION

The Dodd-Frank Wall Street Reform and Consumer Protection Act and Section 14A of the Exchange Act require that we provide our stockholders with the opportunity to vote to approve, on a nonbinding, advisory basis, the compensation of our named executive officers as disclosed in this Proxy Statement in accordance with the compensation disclosure rules of the SEC.

We seek to closely align the interests of our named executive officers with the interests of our stockholders. We have designed our compensation program to reward our named executive officers for their individual performance and contributions to our overall business objectives.

The vote on this resolution is not intended to address any specific element of compensation. Instead, the vote relates to the overall compensation of our named executive officers, as described in this Proxy Statement in accordance with the compensation disclosure rules of the SEC.

Accordingly, we ask our stockholders to vote on the following resolution at the Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, on an advisory basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the summary compensation table and the other related tables and disclosure.”

While the Board, and especially the Compensation Committee, intend to carefully consider the results of the voting on this proposal when making future decisions regarding executive compensation, the vote is not binding on the Company, the Compensation Committee or the Board and is advisory in nature. To the extent there is any significant vote against the compensation of our named executive officers in this Proposal 2, the Compensation Committee will evaluate what actions may be necessary to address our stockholders’ concerns.

The Board recommends that you vote “FOR” the non-binding advisory resolution approving the compensation of our named executive officers, as disclosed in this proxy statement. Under applicable Delaware law, this proposal requires the affirmative vote of a majority of the shares present and entitled to vote. This vote is advisory and is not binding on the Company, the Board or the Compensation Committee.

| 13 |

AMENDMENT TO RESTATED CERTIFICATE OF INCORPORATION TO EFFECT AUTHORIZED SHARE INCREASE